What you need to do to become a self-funded retiree

As a financial adviser that predominately works with young professionals, I can’t emphasise enough the importance of taking responsibility for your own retirement.

It is no secret that the introduction of mandatory superannuation was the first step in what is a long process to unwind the aged pension and we are seeing more and more steps taken by government to encourage people to at least partially self-fund their retirement.

So how do you become a self-funded retiree? In this blog post, I’ll break down:

- What is a self-funded retiree?

- How much you will need to sustain yourself during retirement (both as a self-funded retiree and one who receives a Government pension)

- How you can make sure that your money lasts

- How your money is distributed after you die if there is any leftover; and

- How you can make sure that any extra money you have goes to your loved ones instead of the tax man.

What is a self-funded retiree?

A self-funded retiree is a person who supports their own retirement WITHOUT the assistance of the government pension. For most Australians retiring now, it is likely they will be self-funding at least a portion of their retirement as they may not qualify for the pension for the first couple of years.

Whether you are eligible for the aged pension is assessed taking into account two tests:

- The Income Test

- The Assets Test

You can get up-to-date information about how much income you can earn or assets you can have before you are no longer entitled to the age pension direct from the Services Australia Website.

Income Test

Income Test

As at May 2020, the income a couple who are living together could earn per fortnight before having their aged pension completely cut off is $4,085.20. Any amount earned under this is subject to a sliding scale based on every dollar earned.

It is important to note that this is not just actual income earned and the government will ‘deem’ that you are capable of certain earnings whether you are receiving them or not.

Assets Test

For that same couple, the assets they can hold (excluding their family home) before having their aged pension completely cut off is $869,500 (if they are a homeowner) or $1,080,000 (if they are a non-homeowner.

How do I work out if I’m entitled to a pension?

In determining your entitlement, the government will review both of these tests and apply the one that provides you with the lowest pension. It is also important to mention that these figures regularly change and that there are many exceptions, so it is always worth enquiring with Centrelink before making any decisions.

The figures above however give us a good guide on what you may need to save to be a self-funded retiree for your entire life i.e. your income or assets never fall below this figure.

How much superannuation do I need?

Finding information about how much money you need to retire can be difficult and fraught with danger. For starters, these figures are usually an average and don’t take into account your personal circumstances. A couple living in inner-Sydney is likely to have a lot more expenses than one living in a rural town.

Further, the estimates take into account the spending habits of today’s retirees and not those of the future. I think it’s fair to say that the post-war generation are perhaps a little more frugal on the whole than the rest of us.

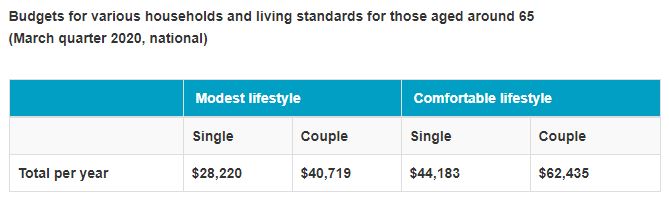

That being said, The Association of Superannuation Funds of Australia (ASFA) have tried to estimate how much you will need in retirement which can be a useful starting point.

ASFA Retirement Standards

ASFA who represents some of the largest super funds in the country puts out a regular paper on how much they consider retirees need to live a ‘comfortable’ or ‘modest’ retirement. You can find further information about this on the Moneysmart Website.

Whilst this doesn’t represent a ‘self-funded’ retiree and assumes receiving the aged pension, it does give a starting point to work from.

Taking into account our couple described above, for them to live a comfortable retirement, ASFA estimates they will have annual living costs of approximately $62,269 per year. ASFA have calculated that this can be achieved with a combined lump sum available at retirement of $640,000 for a couple.

It’s important to note that these figures are estimates only and a number of factors including investment returns have been assumed.

How to calculate how much you need

Before you retire, it’s important to do some calculations for yourself to work out if your money is going to last for retirement using the following 3 steps.

Step 1: calculate your life expectancy

The Australian Institution of Health and Welfare put out some statistics which suggest the average Australian male will live 19.7 years after 65 and woman 22.3 years. To be on the safe side, it may best to assume 25 years.

Step 2: calculate your lifestyle costs

Hopefully at this point in your life you have a dialed in budget and know how much your life costs to live each year. If you don’t, you can get a loose idea by looking back on your past year of bank transactions.

Remember that in retirement you are going to have more free time to pursue interests which may mean increased costs. You will also have increased health costs as you age which need to be factored in. In reality, the $62,269 figure suggested by ASFA is likely too low for most people.

Assuming our example of our couple above, let’s assume that their expenses are $80,000 per year.

Step 3: calculate how much you need

This is where things get a little complex. You are going to need to calculate how much your investment withdrawals are going to affect your investment each year. Fortunately, there is an online calculator that can help you!

Moneysmart have produced a calculator called “Retirement Planner” which can be found here. The calculator requires that you insert your super balance rather than giving you the option to put in your desired lifestyle costs each year but you can reverse engineer it by inputting different values.

For the couple above, I calculated that if they both retired at age 65 today and received no further income, in order to have $80,000 per year, they would need just under $1.4M in their super accounts ($700,000 each). This assumes the aged pension starting from 75 and going until 90.

Please note: there are a number of assumptions as to how this was calculated all of which can be found on the Moneysmart website.

How much would you need to be self-funded?

For the purpose of this article, I’ve tried to use publicly available calculators so you can follow along.

Sadly, I was unable to find any public calculators which could calculate this so had to use our specialised financial planning tools.

In doing so, I worked out that for the same couple to be self-funded, i.e. their investment is still worth greater than $869,500 at the age of 90, they would need about $2.1M (i.e. $1,050,000 each).

Please note that this amount takes into account a lot of assumptions including assumed investment returns, assumed pension draw down rates and other variables. This figure is not meant to be an accurate figure but instead provide a ballpark amount of what you may need. When it comes to savings, more is always better.

How do I make my super last?

The scariest part about retiring is knowing that once you do it, you don’t get a second chance. If you miscalculate how much you need, there usually isn’t an option to go back to work for a couple of years to make up the difference.

For this reason, the strategies you employ for retirement to make your money last will make all the difference.

There are a few big mistakes I see retirees make which can mean that their super doesn’t last and I’ll address them below.

Superannuation is an amazing retirement tool but sadly it is incredibly complex. For this reason, many retirees feel uncomfortable about their super and would rather just pull the money out and put it in their bank account. But this is a very expensive mistake.

The first problem with this is that you are moving your money from a potentially tax-free environment to a taxed one. Depending on how much you earn in interest each year (i.e. if it’s over the tax-free threshold), this could be costing you thousands of dollars.

If you move the money from super, you are also potentially missing out on investment returns which leads me to my next mistake.

I mentioned above that the average life expectancy from 65 for a man was 19.7 years and for a woman was 22.3 years. That’s a lot of years and a lot of investment cycles.

Too often, retirees move the entirety of their superannuation to low risk investments on day one of their retirement. Whilst it’s important to de-risk your portfolio as you move into retirement, you need to ensure that you are still trying to achieve returns to make your money last.

A common strategy we employ is having two separate investment pools. In one pool, you have your more conservative investments that you can draw on over the next couple of years. In the other pool however, we will have a larger exposure to higher growth investments.

How much you allocate to each pool depends on your circumstances and plans and should be adjusted regularly. Seek advice before going down this road.

How do I know how much to spend?

It’s a well known fact that many retirees spend less than they could out of a fear of spending too much money. Given life-expectancy is uncertain this is a pretty sensible strategy. If you want certainty about how much money you can spend each week, there are options available.

An annuity is a product which provides you with a guaranteed income either for your lifetime of a fixed term of your choice. For anyone who has the money and is willing to pay a premium for certainty, annuities can be a great option to make sure you get the most out of these years instead of being concerned about whether you are spending too much.

What happens to my money if I have some leftover?

Hopefully, by this stage you have seen a good Lawyer and have a Will and Power of Attorney in place.

Whilst your Will can deal with things like your house, cash and any other assets you have, your superannuation benefit doesn’t form part of your estate and so therefore can’t be gifted in your Will. This means you need to have other plans for it.

Why does my Superannuation not form part of my estate?

Your superannuation fund is technically a trust, which means that someone else (the trustee i.e. super fund) is holding the money on your behalf. When you die, the trust continues and deals with the money either in accordance with your instructions or at its discretion.

Binding Death Benefit Nomination

As part of your superannuation arrangements, the trustee (i.e. the super fund) can decide who receives your superannuation balance. They may have regard to your Will in determining who they would like to give your money to but it isn’t binding on them.

If you would like to decide who gets your superannuation balance, you will need to complete a Binding Death Benefit Nomination (“BDBN”).

A BDBN is a binding direction on the trustee to pay your super balance in accordance with your wishes. You can only put in place a BDBN if your superannuation fund allows it and they all have different conditions.

Another quirk of the BDBN process is that you can’t just gift your money to anyone, they need to be considered your ‘dependent’. A ‘dependent’ for superannuation purposes includes:

- A spouse (including de facto, opposite and same sex)

- Children of any age (including adopted or ex-nuptial)

- Any person(s) financially dependent on you

- Any persons(s) in an interdependency relationship with you; or

- Your legal personal representative (the person who is distributing your estate).

You may also have the option of putting in a place a non-binding nomination which will inform the super fund of your wishes but which they don’t need to follow.

Reversionary Beneficiary

Some superannuation funds allow you to set up what is called a ‘reversionary beneficiary’. A reversionary beneficiary is the person who will start receiving the income stream you were receiving prior to death.

Each superannuation fund has different rules about who you can name as a beneficiary and how they apply. There are also different tax consequences associated with receiving a lump sum or an income stream so getting advice about what would apply in your circumstances is really important.

How much will I need to pay in tax when I die?

The tax payable on your super benefit depends on a number of factors including:

- The relationship and age of the person you are gifting the money to

- Whether the money is being provided as a lump sum or an income stream; and

- The way the money was paid into the superannuation fund (i.e. was it paid by your employer or by salary sacrifice as a “concessional contribution” or did you pay it direct into the super fund as a “non-concessional contribution”).

The nuts and bolts of this is outside the scope of this article but needless to say, getting advice here is really important. There are a number of strategies that can be used which might provide a better tax outcome and I’ll touch on a couple below:

WITHDRAW YOUR MONEY

In most instances, retirees can withdraw lump sums from their superannuation benefit tax free. This can then be gifted as part of your Will without incurring additional tax.

A common strategy that many people employ is to start withdrawing lump sums from their super at the later stage of their life. These lump sums then form part of their estate and can be gifted in their Will without incurring any tax.

Depending on the circumstances including whether the benefit is subject to tax and who they are gifting this to, this can be a good strategy, particularly when you have a bit of certainty around how long you’ll need your super benefit for. On the flip side, this strategy can be really bad for some people such as those who have significant debts owing upon death.

THE RE-CONTRIBUTION STRATEGY

Your superannuation benefit is made up of different components of money which each have different tax consequences. Depending on who you gift your money to, these different tax components can have a big effect on how much they will ultimately receive.

A common strategy employed by retirees is to withdraw lump sums tax free from their superannuation benefit and then recontribute it changing the underlying components and the tax treatment.

This strategy is powerful when done correctly but I’ve seen people get this wrong and suffer some pretty severe consequences.

If you are uncertain in anyway, it is always best to seek advice. A simple mistake here can cost you thousands of dollars so it’s worth doing your research.

What if my superannuation benefit is a ‘Defined Benefit’ Account

The information provided above assumes that you have an Accumulation Account which are the most common accounts for young people. If you have a ‘Defined Benefit’ account, your circumstances will be markedly different and will depend on which super fund you hold the account with. In this instance (and in general), it is best to seek advice.

Final Thoughts

Retirement and all the associated rules are complex and change regularly which means you need to be across these changes, otherwise you may find yourself disadvantaged.

Doing extensive research or having a financial adviser who can assist you during this period could save you thousands of dollars.

If you have any questions or want to have a chat, please don’t hesitate to reach out.

This post is from our resident Financial Planner Ben Brett, check out his details in the About Us section.

Want more information like this? Of course you do, sign up to our newsletter and we’ll keep you informed.

Posted in: Ben Brett, Superannuation