Review your home loan and get an extra $200 each month

‘I have a home loan but I really want to start investing soon.’ This is something that I hear on the reg, but the hard part can be finding the extra money without having to forgo your lifestyle.

One of the easiest things to do to find that money, is to check your home loan to see if you can do a better deal. It costs you nothing and if it doesn’t work out for you, then no harm done.

The average home loan in Australia is about $374,050 (or I’ll round up to $400,000). As this goes to print the average interest rate is 4.37%*.

So, if you had a home loan of $400,000 and an interest rate on your home loan at 4.5% but you could reduce that to 3.9% (which by the way is the current ‘standard’) then you could be saving yourself $200 per month. There you go, I just found the money you need to start your very own investment portfolio without having to change your overall lifestyle.

With the RBA Cash Rates as low as they are (1.5% for the last 17 months!) the question is not if they will rise, but when. Eventually, we are going to see interest rate rises at some point, so now is a good time to start thinking about your home loan and whether you want to re-evaluate.

You may be able to get a better interest rate which could save you money each month. It’s good practise to re-evaluate every couple of years just to make sure.

Now that you theoretically have the money, what could it turn into if you play your cards right (no I’m not talking about gambling it either).

Case study: As the average home loan in Australia is around $400,000, I used this as the basis to do some loose calculations to show you what the outcome would be.

- Home loan of $400,000

- Initial interest rate 4.5%

- New interest rates based on current market conditions: 3.9%

Based on this interest rate change alone, you will save about $200 per month. That’s not small change.

If you have been making the repayments anyway and gotten used to doing so, you could take that money and do something else with it.

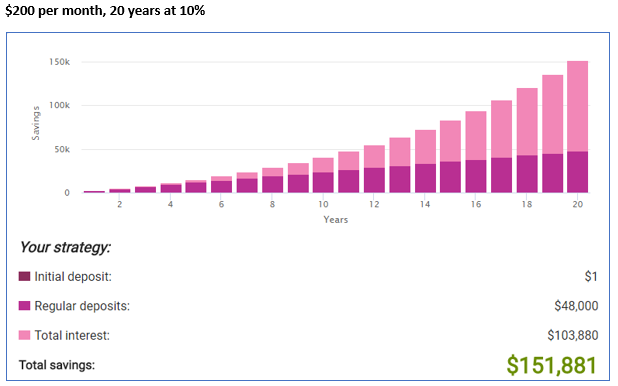

Now I try to keep away from the graphs because I don’t want your eyes to glaze over too much, but they do tell a good story on this one, so please stick with me.

So, the graphs are exciting aren’t they? Ok, maybe they aren’t that great to you, so let me give you the low down. For the average GenY, if you took that $200 and invested it for the next 20 years at 10%, you would have $151,881. If you put that same amount into a bank account you would only have $48,000. That’s a pretty big difference.

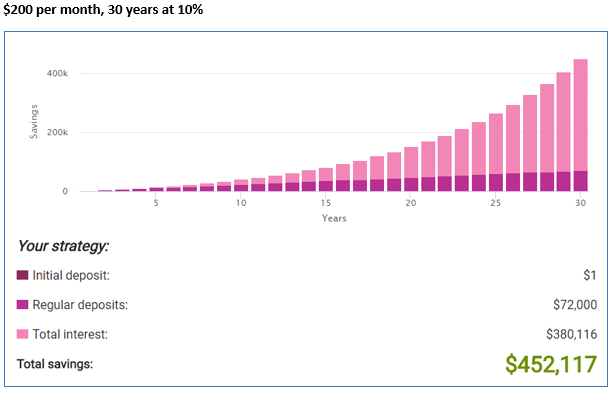

We did a few different calculations to show you the effect of 30 years, which works out to be an astronomical $452,117. As you can see, the longer the better with this kind of thing. It’s the beauty of compound interest.

The thing about compound interest is that the earlier you start, the better it is going to be for you.

So, if you have a home loan and have not reviewed it for a couple of years, it’s worth checking what is out there. If you can save yourself $200 per month you could be doing something substantial with that.

We know some pretty epic people in this arena, so let us know and we’ll put you in touch.

What more information like this? Of course you do, sign up to our newsletter and we’ll keep you informed.